By Christopher Young,

Contributing Writer,

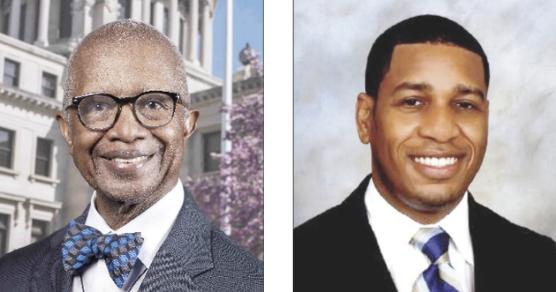

photo courtesy of Dr. Green

The responsibilities of a governor are enormous and affect all the residents of a state, not just some; in Mississippi that now means a population of 2,939,690. Our current governor always claims to govern for all Mississippians, but we know that is not true.

Among the governor’s responsibilities are to appoint officials to lead state agencies, like transportation and health. These people manage operations and execute the governor’s policies. The governor is also responsible for budgeting and financial management. Governors prepare and submit annual state budgets to the legislature. They outline revenue expectations and propose expenditures for critical sectors like healthcare, education and public safety.

Once the legislature approves the budget, the governor ensures that funds are allocated as directed, per https://politically-informed.com/state-governors-responsibilities.

Mississippi’s Legislative Budget Office estimates the General Fund will have $7.627 billion to operate with for Fiscal Year 2026. The State Income Tax, referred to in the budget as Individual Income Tax, accounts for $2,117,800 billion or 27.77% of the General Fund. On March 27, 2025, the Governor signed HB1 into law. Referred to as the Build Up Mississippi Act – that 2+ billion dollars will disappear, incrementally, from the General Fund over the next ten years. The new law also decreases the state’s overall grocery tax from 7% to 5% yet increases gasoline tax – already at 18 cents per gallon – by three cents in each of the next three years, bringing the total gas tax to 27 cents per gallon. Initially, HB1 increased sales tax by various amounts, but that was dropped from the final language of the bill – for now.

Senator Hillman Terome Frazier has seen it all in his forty-five years in the Mississippi Legislature and knows this new law will hurt our state. He speaks plainly about the new law that he voted against. “The income tax cut will not be noticeable by the middle and lower class (earners), and all residents will pay more at the pump.”

Considering the high poverty rate in our state – the poorest state in the nation, and the state that ranks dead last (50th) in health care, I asked Senator Frazier if there had been any action this session on health care, specifically supporting Mississippi’s rural hospitals. He answered, “Not this session. And Medicaid expansion is not being discussed either because of uncertainty in Washington, D.C.”

He also noted that some Senate Democrats helped Republicans pass the tax bill on March 18th, seeming to demonstrate that cutting taxes is more of a priority than helping the rural hospitals.

This link allows you to review the votes, https://legiscan.com/MS/rollcall/HB1/id/1520027.

Governor Reeves never talks about the state’s debt. Families and businesses talk about their debt, but the Mississippi government – not so much. Our debt is so high that taxpayers are now scheduled to pay $474,652,860 – nearly half a billion, just to service the debt for FY26, per https://www.lbo.ms.gov/PublicReports/GetBudgetRequestDetailReport/0?report=Complete&fiscalYear=2026. On page 457 of 600 pages above, Mississippi claims its debt is $6 billion.

Another massive chunk of debt being discussed now is PERS debt. The state’s contribution to its own Mississippi Public Employee Retirement System has lagged for decades and now stands at $25+ billion. By failing to contribute their share, the legislature demonstrates its low priority for public school teachers, agency employees and certain city and county employees. HB1 adds a new tier for PERS hires effective March 2026 – those folks will ultimately receive less when they retire, but the addition of the new tier does nothing for the existing debt of the system.

Some Mississippians are excited about the changes in the state income tax, despite the state’s massive debts. It sounds good to them to have a few extra dollars in their pocket. Are they considering the impact of an almost certain reduction in public services that will affect them and their neighbors? Consider If you are working for minimum wage in Mississippi, you are earning $290 for forty hours and are paying $11.60 in income tax each week. The Bureau of Labor Statistics tells us that Mississippi, Louisiana, Rhode Island and D.C. have the highest percentage of low wage (minimum wage of $7.25) workers in the nation. Sixteen other states have a much lower percentage, and the remainder of states have increased their minimum wage. Raising the minimum wage in the poorest state – a state with the highest percentage of minimum wage workers – is never a serious discussion at the Capitol.

And what about our health care? The Center for Healthcare Quality and Payment Reform reported in February 2025, that “38 rural hospitals in Mississippi, or 57%, are at risk of closing.”

Dr. Torrance T. Green, a nephrologist with Baptist Healthcare System and Southwest MS Medical Center in McComb, in addition to his private clinic – Good Faith Wellness in Flowood, shared his concerns about limited state resources being applied to health care. “I saw this up close in Vicksburg almost two years ago. The losses of services and the taxes they generate will be detrimental. Where is the prescription for growth? State funds are being spent in the Metro Area but look how far you have to drive if you live outside that. Even if Medicaid were expanded, the state doesn’t seem prepared to fund its small percentage, thereby leaving millions on the table that could improve the lives and health of Mississippians.”

At the signing of HB1, the Governor said in part, “The legislation I’m signing today puts us in a rare class of elite, competitive states. There are only a handful of states in the country that do not tax income. Today, Mississippi joins their ranks – and in doing so, we plant our flag.” Reeves believes that this action will make us more competitive. It’s so sad to hear him use the word elite, when the health of our population is the worst in the country.

Dr. Green believes that not investing more in health care makes Mississippi less attractive. “What is the relationship of health care to growth for our state? Even people with great insurance are not always near to services. This relationship doesn’t make Mississippi more competitive. When we don’t invest in updating services and equipment, facilities are forced to transfer patients to where the services are and loved ones are out of luck. The traditional model of medical services gets fractured by lack of equitable investment, and then poor reimbursement rates force physicians – who rely on those same dollars to support their own families – to go to larger hospital systems, and small practices in rural areas suffer.”

In 2024, only nine states had no income tax – Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming. Like Mississippi, seven of those nine states are in the bottom half of healthcare rankings, per U.S. News & World Report. Most of these states have other huge assets like tourism, oil and gas. Mississippi doesn’t.

In Mississippi we just stumble on – shooting ourselves in the foot on a regular basis. It’s a byproduct of being wrongheaded, not caring about your entire population. Governors do have a legislative role – they have the power to veto, and they have the power to set policy and make policy recommendations to the legislature. Incumbent Governor Reeves won a second term with 50.9% of the vote, according to NBC News. Now he has achieved his signature policy goal of eliminating the income tax, despite his responsibility to do what’s best for all Mississippians.

It’s an immoral way to govern – rewarding people of means, while perpetuating pain and suffering for most Mississippians. It’s a shell game that cuts one tax while raising others in the poorest state in the nation, a state deeply in debt from generations of wrongheaded leadership. Some are honest enough to acknowledge the obvious that poor people are the only people in Mississippi that the Republican leadership hate more than minorities. Eliminating the state income tax is proof they are right.

Be the first to comment