Last week, Courtroom No. 7 of the Hinds County Courthouse in downtown Jackon was a very popular place for bidders on the county’s delinquent property taxes. People from around the country traveled to Mississippi to bid on tax liens.

By definition, a tax lien is the right, usually by the county, state, or federal government, to take possession of property due to a delinquency on property taxes, or even income taxes.

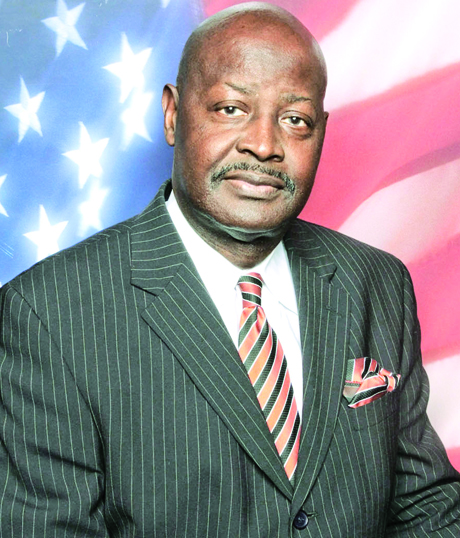

Held annually, the county’s 2010 tax sale auction grossed $14 million according to Tax Collector Eddie Fair. “Last year, we did $9 million in tax sales. We had more [tax delinquent] parcels than we’ve had in a while,” Fair told The Mississippi Link. “Our tax sales usually run four days. This year, they ran five days. Where we generally have had 8,000 to 9,000 parcels; this year, we had about 13,000.”

Fair pointed out that the parcel listings not only consisted of single-family homes, but also numerous businesses.

While the county benefits from such auctions, Fair personally feels it is a bittersweet situation. “We don’t want to see anyone lose their property. I want it understood that we have good people (property owners). They just fall into bad situations, especially now with the way the economy is,” he said.

At last week’s tax sales, according to one bidder who wished to remain anonymous, there are basically two kinds of people who frequent delinquent tax sales: investors seeking to gain interest on tax lien certificates and individual tax buyers seeking to own property.

In Mississippi, the annual percentage rate (APR) on a tax lien certificate is 18 percent. The redemption period (the time in which the owner has to pay the delinquent taxes and regain the property) is two years. If the delinquency gets up to the third year then it matures over to the first highest bidder for the first year. If that bidder for some reason does not file a tax deed for the property, then it goes to the highest bidder for that second year.

According to the Hinds County Chancery Clerk Office, no property goes unsold. If no one purchases the tax sale on the property, then it is sold to the State.

Jackson native Bennie Wansley is a homeowner today because, in 2006, he bidded on the house that he rented for several years and won the bid. “The house became mine in 2009. I have the deed. In 2006, I paid $358.78 taxes plus the $10 I bidded for a two-bedroom house on Morton Avenue. No credit checks, no down payments or closing cost,” Wansley explained. He was the only person to bid on the property that year.

Wansley said he would like others to learn the process of gaining property through tax liens, especially African Americans. “I’m still learning the process, but this is a good way to become a homeowner. As long as the owner does not redeem [pay the taxes] on the property during the redemption period, the property is yours if you pay the taxes,” he said.

However, legal experts caution individuals to do research before getting involved in bidding on a piece of delinquent real estate. Some properties have risky circumstances (i.e. bankruptcies, heirs and other conflicts). Others say the process is one of the lowest risk investments one can make.

Eddrick Hicks, who was in the courtroom to observe last week’s auction, is heeding caution. “This is my first time being here; I just want to see how it works,” he said as he tried to follow the tax parcels as they were being bidded on. “I plan to be here bidding next year,” he whispered.

It is also important for long-distance property owners to keep abreast of tax situations regarding their property as well.

Evelia Jones, a Jackson native, but longtime California resident, was not aware that notices had been sent out regarding delinquent taxes on family property she owns in Jackson.

For the last year, someone who claimed to be a family member paid the taxes. It was when she tried to transfer ownership from her late parents’ name that she discovered someone in Madison County was getting her tax notices.

Jones immediately sent funds to a childhood friend to pay the taxes on her home. She could have lost it had not the discovery been made.

While Fair also want people to educate themselves about the consequences of not paying their taxes, he also understands that there are often unforeseen circumstances that cause taxpayers to fall behind. Some forget, experience financial setbacks, never receive the notices or might experience health disabilities.

For example, Wansley said the person who owned his home was diagnosed with Alzheimer’s and forgot to pay the taxes, and the next of kin (person in charge), later decided she could not afford the property upkeep.

“The collections were very good for the county, but bad for the people that did not have the means to pay their taxes,” said Fair.

Fair said on Sept. 19, the $14 million in tax sales will be divided and distributed to various municipalities, school systems and to the county itself.

Be the first to comment