JACKSON, Mississippi (AP) — Speaker Philip Gunn and other House Republicans are moving forward with a plan to phase out Mississippi’s personal income tax, despite questions from opponents about whether the state could pay for services if more than a quarter of its current revenue were eliminated.

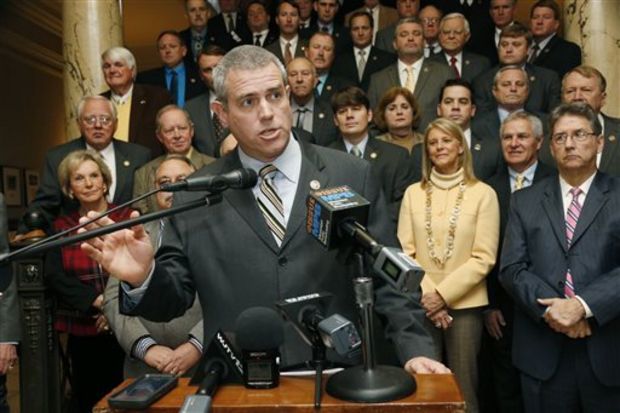

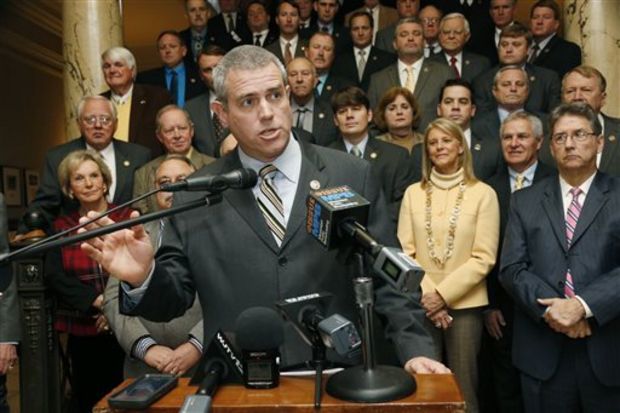

“We as Republicans decided that if we’re going to do a tax cut, and that is going to be a matter of discussion, we want it to be real,” Gunn, of Clinton, said in a Tuesday news conference at the Capitol. “We want it to be significant. We want it to count, and we want to give meaningful tax relief to the working families of Mississippi.”

The House Ways and Means Committee voted 15-7 Tuesday to advance House Bill 1629, moving it to the full House where it will need a 60 percent majority to pass. Democrats, who control enough votes to block the measure, were already signaling opposition.

“I think it’s playing very loose with public policy,” said Rep. Steve Holland, D-Plantersville. “We have such extraordinary needs. We’ve always had extraordinary needs, and I think this philosophy is wrong-headed that you give it back to the people and it prospers the economy.”

This is a state election year. Republican Gov. Phil Bryant, who has said he wants some sort of tax cut, is running for re-election, as are Republican Lt. Gov. Tate Reeves and most lawmakers of both parties.

Gunn said the plan would cut $1.38 billion in taxes in steps through 2028, pausing in any year when state revenue didn’t grow by 3 percent. However, that total is based on partial collections from the 2012 calendar year, according to the state Department of Revenue.

The state income tax is projected to collect $1.74 billion in personal income taxes this year, according to projections by the Legislative Budget Office.

The proposal could shift the debate away from proposals to cut business taxes. Reeves proposed a $382 million tax cut earlier, including phasing out the $242 million franchise tax.

Opponents warn that the plan could starve state agencies of needed revenue and leave the state’s tax system more regressive than now.