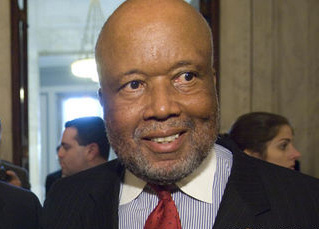

JACKSON, Mississippi – (AP) — Mississippi Insurance Commissioner Mike Chaney plans to move ahead with a health insurance exchange for small businesses after federal officials approved regulations to allow the move.

The Department of Health and Human Services had proposed a rule that would have barred states that didn’t run an individual marketplace from setting up a separate exchange for businesses with fewer than 50 employees.

Last week, federal officials adopted a rule advocated by Chaney that allows Mississippi to set up what’s called a Small Business Health Options, or SHOP exchange. Chaney said he’s scheduled to meet Sept. 18 with federal officials and expects to get formal approval then, with plans to roll out the new marketplace in early 2014.

Utah already has approval to run only a SHOP exchange, and Chaney said he knew of no other state besides Mississippi expected to follow that route immediately.

Chaney fought for Mississippi to run the individual marketplace as well. But his effort was blocked by Gov. Phil Bryant, a fellow Republican, who opposes participation in the federal health overhaul known as the Affordable Care Act. As a result, the federal government will run Mississippi’s individual market when enrollment begins Oct. 1.

The elected insurance commissioner said he has the authority to run the small business market without Bryant’s approval. Bryant spokesman Mick Bullock said Thursday the governor’s office wasn’t familiar with the details of Chaney’s plan and declined further comment.

While federal tax credits will subsidize the insurance purchases of many individuals, the small business exchange would not be subsidized. Chaney and others, though, hope that a central marketplace that attracts large numbers of users will help cut prices and increase the number of insurer offerings.

“My goal is to foster competition, to lower prices for the consumer and offer them some choice,” Chaney told The Associated Press in a Thursday telephone interview.

The SHOP-only option was opposed by the liberal-leaning Center on Budget and Policy Priorities.

“We believe that such an arrangement is not ideal because it forgoes efficiencies and coordination that can only be realized when the same entity (a state or HHS) administers both the individual market exchange and the SHOP,” CBPP wrote in a July 18 comment letter. The center warned it could hurt efforts to finance the federally run individual marketplaces and complicate enrollment transfers between an individual market to a SHOP market.

Chaney said he thought hundreds of thousands of Mississippi employees could benefit from the online market, but he said he wasn’t sure how many businesses would participate.

Individuals would choose health plans on the market that launches Oct. 1, assisted by what the federal government calls navigators. Chaney said commercial insurance agents and brokers would help employers choose plans on the small business market. Those intermediaries are typically the guides for small employers today.

Insurers would pay a fee of between 2 percent and 5 percent of revenue from policies sold on Mississippi’s SHOP exchange to finance its operations. Chaney said the state needs about $1 million a year. Those fees could result in reduced commissions to agents.

Set-up will be financed by federal grants that Mississippi retained after its individual exchange was rejected. Chaney said the state would repurpose some of the more than $10 million remaining.

Mississippi’s individual marketplace has struggled, with most counties only having one company offering coverage. Originally, 36 of 82 counties were without coverage, but Chaney and federal officials enticed Humana Inc. to offer policies in those areas, ensuring all Mississippians would have a coverage option.

Chaney said he hoped for broader participation in the small business market. But he said it wasn’t clear whether the state’s largest private insurer, Flowood-based Blue Cross & Blue Shield of Mississippi, would participate.